Are you living paycheck to paycheck?

Or are you a little better off but looking to brush up on the basics?

Money is a tricky subject, and so few people can talk about it honestly. That leads to a lot of confusion over what you should do with your hard earned cash.

We created this simple guide to managing your money so you can build your wealth consistently, day by day.

No, we don’t have any “get rich quick” schemes—and if we did, we’d be on a boat right now.

A really nice one.

Rather, these are a series of basic steps that you can take to bring tremendous changes to your financial life over time.

Let’s dive in.

Skip Ahead

Step 1: Read Up

The first step to building wealth comes from understanding a set of money principles. We’ll cover some big ones like setting aside a portion of your income, the power of compound interest, and how giving can create a sense of abundance.

But we came across each of those topics through books. And each subject has countless books written on it, too.

Financial literacy is hard-earned. But the beauty is that you can learn from others’ mistakes and apply the lessons they learned on their path out of some pretty deep ditches.

One of our favorite books on money management is Dave Ramsey’s Total Money Makeover. In it, Ramsey outlines the easy-to-follow process he used to get out of over $350,000 in debt.

Matt D’Avella, arguably YouTube’s most famous minimalist (we highly recommend his channel), lists it as one of six books that changed his life. It also changed ours, and it could change yours too.

If you’re reading this article, you’re on your way to financial freedom. But you’ll need more than just a few thousand words to get you through your lifetime of financial wellness.

A few other excellent books on money management and investing are Money: Master the Game by Tony Robbins, and for something a little more approachable, check out Broke Millenial by Erin Lowry.

Step 2: Set a Budget

The most powerful way to save or pay down debt is to set a budget. Yes, it may sound boring, or it may even be frightening, but understanding where your money is going is crucial in reaching any financial goals you have.

We recommend Every Dollar for budgeting software—there’s a free version and that’s all we’ve ever needed.

In setting a budget, it’s critical that you start with what you’re saving.

Pay yourself first.

After you’ve allocated a budget to your savings, then you set aside funds for your bills, debts, and fun things like nights out at the bar.

You may blow your budget the first few months, but keep at it. We’ve found that budgeting is a practice, and you’ll get better the more you do it. Soon, it becomes a fun challenge to see how much you can save every month or how quickly you can pay down your debts.

And when you’ve reached that point, you’ll be in a position of power—trust us, it feels good and is well-worth the work.

Step 3: Create an Emergency Fund

As you’re setting up a budget, build an emergency fund.

A good rule for how large your fund should be is three to six months of living expenses. This helps mitigate the risks of everyday life.

If you get fired, you’ll have a few months to lick your wounds and find something different. If your car blows a tire, you won’t even sweat it.

And emergency funds have an advantage beyond security. Having a chunk of cash saved up will also allow you to jump on opportunities as they come. If there’s a new business venture you want to try, but you’ll need a few months to really give it a go, you have the option.

Your emergency fund can create opportunities that may multiply your wealth, or at least allow you to maneuver closer to your ideal life.

Step 4: Save and Invest

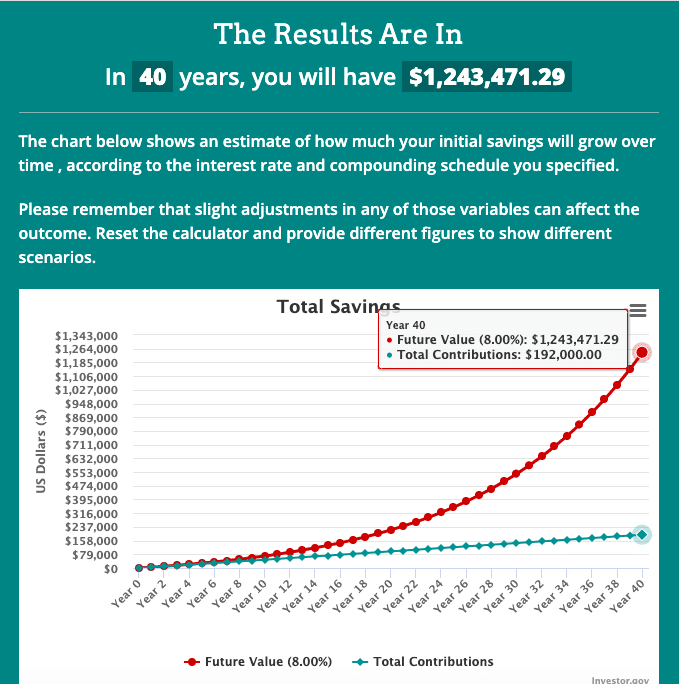

Compound interest is called the eighth wonder of the world.

Here’s why:

It’s possible for someone who makes $40,000 a year to become a millionaire. How? By saving 10% of every paycheck and investing it.

If the investment grows at the historical market average of 8% every year, in 40 years, you’ll have $1.2 million dollars. It’s simple math, and it seems pretty do-able, right?

But what do you invest in? Many experts recommend what’s called a “diversified portfolio.”

Basically, a diversified portfolio includes a range of different “assets,” which can be stocks, bonds, real estate, or a variety of other things.

Stocks and bonds are easy enough to invest in—just open a brokerage account with one of the major companies and you can get started in the same week (though we recommend reading a few investment books before getting started).

While real estate has historically been a consistent earner, it can be tricky to get into. Luckily, there’s something called a REIT, or Real Estate Investment Trust.

Until REITs came along, real estate investment meant you bought properties and renovated or held on to them until they appreciated in value. But REITs offer the ability to buy shares in developments, which lowers the bar and gets rid of the headache of buying and managing a property.

REITs were only available to the wealthy until a new law in 2015 allowed non-accredited investors to join in.

Now, it’s easy to invest in real estate, and companies like DiversyFund allow you to start with only $500. Even better, they don’t charge any fees, which can cut into your bottom line.

DiversyFund's mission is to allow Americans outside of the 1% to invest in real estate and diversify how they build wealth. With a minimum investment of only $500, own a piece of a multifamily real estate portfolio that's fully vetted and SEC approved.

We took a close look at DiversyFund and here’s what we thought.

DiversyFund Review

What I Like

The $500 minimum makes real estate investing a possibility for many folks.

DiversyFund’s platform is easy to use and signing up is a breeze.

The customer service is solid—they offer plenty of investment resources and are quick to answer emails.

DiversyFund’s properties are well-diversified. Even if one development goes south, there are several others that will likely offset the loss.

They charge no fees. Since you’re putting in the risk, you’re getting the returns.

What I Don’t Like

Like all real estate investments, it’ll take several years for your investments to appreciate. Any cash you put in won’t be liquid for three to five years.

DiversyFund has a good investment record so far, but it’s still a relatively new company.

What Other Reviewers Say

DiversyFund has earned an “Excellent” review rating on TrustPilot, with over 150 reviewers chiming in.

The negative reviews mainly stemmed from one issue. Some investors weren’t aware that their money would be tied up for up to five years.

DiversyFund has historically brought solid rates of return, which makes most reviewers happy, but it’s critical to know that you won’t be able to access your investment for several years.

The Verdict

We recommend DiversyFund for folks who have some experience in stocks and bonds, but are looking to build out their portfolio with a broader range of assets.

Beginner investors can feel comfortable with DiversyFund, as their platform is easy to use and the barrier of entry is low at only $500. But beginner investors may also take issue with the time it takes for their assets to appreciate.

The biggest benefit to DiversyFund, besides the investment minimum, is their commitment to zero fees.

As you do your financial literacy research (step 1) you’ll learn that fees can crush your long-term earnings. Plus, if you’re putting in the risk, why shouldn’t you get the return?

More experienced real estate investors will probably skip this opportunity in favor of buying and managing their own properties, but for those new to the market, DiversyFund is a simple way to get started.

DiversyFund's mission is to allow Americans outside of the 1% to invest in real estate and diversify how they build wealth. With a minimum investment of only $500, own a piece of a multifamily real estate portfolio that's fully vetted and SEC approved.

Bonus Step 5: Give

Yep, our fifth step is a little counter-intuitive.

You might ask, “how am I supposed to build my wealth by giving some of it away?”

Giving impacts how much you receive. Sounds strange, right?

Some give 10% to their church, others donate to charities and causes. Many who do so believe there is a spiritual reason to do so, but that’s a discussion for another day.

The psychology of giving is interesting to understand.

Studies show that people who give a portion of their money to charities and organizations report a higher level of happiness. Beyond that, living on less than you make creates a sense of abundance.

Knowing you have more than you need can lead to your ability to see more opportunities, take bigger risks, and ultimately cultivate more success.

If you’re not sure where to start, take a percentage of your next paycheck and give it to something you believe in. How do you feel?

Can You Manage?

Managing your money is simple. But no one said it was easy.

The five steps outlined above can change your life, but only over several years. The progress will feel slow, and many will give up before the big results start pouring in.

So continuously brush up on your financial fundamentals. Reread your favorite personal finance book once a year, or find a podcast that fires you up. And with investing, automate the process.

DiversyFund and most other brokerages allow you to automatically deduct a certain amount from your bank account each month. Saving is so much easier when you don’t have to think about it.

Practice these steps every month, and within a few years, you’ll see a big impact on your bottom line.